Examine This Report about Estate Planning Attorney

Examine This Report about Estate Planning Attorney

Blog Article

The Buzz on Estate Planning Attorney

Table of Contents8 Simple Techniques For Estate Planning AttorneyHow Estate Planning Attorney can Save You Time, Stress, and Money.The Estate Planning Attorney DiariesLittle Known Facts About Estate Planning Attorney.

Your attorney will certainly also assist you make your files authorities, preparing for witnesses and notary public signatures as required, so you don't have to worry about attempting to do that final action on your very own - Estate Planning Attorney. Last, yet not least, there is important assurance in establishing a relationship with an estate preparation lawyer who can be there for you in the futureJust placed, estate planning lawyers supply worth in several methods, far past just supplying you with published wills, counts on, or various other estate planning papers. If you have inquiries about the process and intend to discover more, call our workplace today.

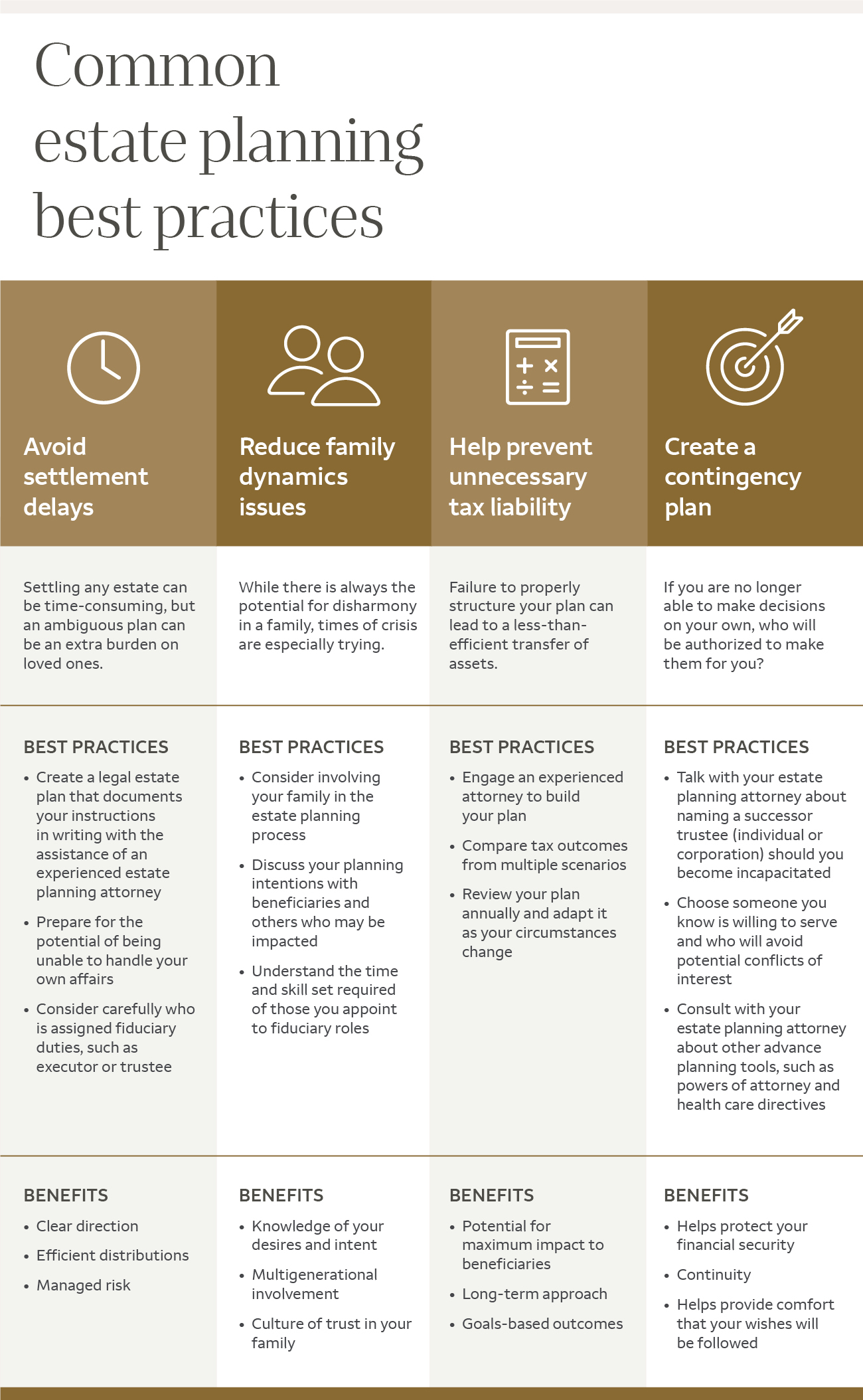

An estate planning attorney aids you formalize end-of-life choices and lawful records. They can set up wills, establish trusts, create health care regulations, develop power of attorney, produce sequence strategies, and a lot more, according to your dreams. Collaborating with an estate preparation attorney to complete and supervise this legal paperwork can aid you in the following eight locations: Estate intending lawyers are professionals in your state's trust fund, probate, and tax legislations.

If you don't have a will, the state can choose how to divide your properties among your heirs, which might not be according to your wishes. An estate planning attorney can assist arrange all your legal papers and distribute your possessions as you wish, possibly staying clear of probate. Lots of people draft estate planning papers and afterwards ignore them.

8 Easy Facts About Estate Planning Attorney Explained

When a client dies, an estate strategy would certainly dictate the dispersal of possessions per the deceased's instructions. Estate Planning Attorney. Without an estate strategy, these decisions might be entrusted to the next of kin or the state. Obligations of estate organizers include: Producing a last will and testament Setting up depend on accounts Naming an administrator and power of lawyers Identifying all recipients Calling a guardian for small children Paying all financial debts and lessening all tax obligations and lawful fees Crafting directions for passing your values Establishing preferences for funeral setups Completing instructions for care if you become unwell and are unable to choose Acquiring life insurance coverage, impairment earnings useful source insurance, and long-term care insurance coverage A good estate plan ought to be updated consistently as customers' financial situations, individual motivations, and government and state legislations all advance

As with any career, there are characteristics and abilities that can help you accomplish these objectives as you deal with your clients in an estate planner role. An estate preparation job can be ideal for you if you have the complying with attributes: Being an estate coordinator implies assuming in the long-term.

Not known Details About Estate Planning Attorney

You must assist your client anticipate his/her end of life and what will happen postmortem, while at the same time not house on dark ideas or feelings. Some customers may end up being bitter or distraught when contemplating fatality and it can be up to you to assist them via it.

In case of death, you might be expected to have countless conversations and dealings with enduring family participants concerning the estate plan. In order to succeed as an estate coordinator, you might need to stroll a great line of being a shoulder to lean on and the individual relied on to connect estate planning issues in a prompt and professional way.

Anticipate that it has been changed better given that after that. Depending on your customer's financial revenue brace, which may develop towards end-of-life, you as an estate organizer will have to keep your client's assets in complete legal compliance with any regional, government, or international tax regulations.

Fascination About Estate Planning Attorney

Gaining this certification from organizations like the National Institute of Certified Estate Planners, Inc. can be a strong differentiator. Belonging to these specialist groups can confirm your abilities, making you more appealing in the eyes of a possible client. Along with the psychological benefit of helping customers with end-of-life planning, estate organizers enjoy the advantages of a secure earnings.

Estate preparation is a smart point to do no matter of your existing health and wellness and economic standing. Not so lots of people understand where to start the procedure. The initial vital point is to employ an estate planning lawyer to assist you with it. The following are 5 benefits of functioning with an estate preparation lawyer.

The portion of individuals that don't understand how to obtain a will has increased from 4% to 7.6% since 2017. A knowledgeable attorney understands what information to include in the will, including your beneficiaries and special factors to consider. A will shields your family members from loss due to the fact that of immaturity or incompetency. It likewise provides the swiftest and most efficient method to transfer your assets to your beneficiaries.

Report this page